Every week, Rinchem shares important articles and topics about chemical and gas logistics, industries we operate in, and the general global supply chain. In this week's review we discuss the semiconductor industry's major concerns, supply chain uncertainty in 2026, and AI's booming demand.

Keep reading to see this week's hot topics.

This week's stats

93%- of semiconductor manufacturing leaders expect revenue growth in 2026 Manufacturing Drive

$364 billion- global semiconductor sales in first half of 2025 EE|Times

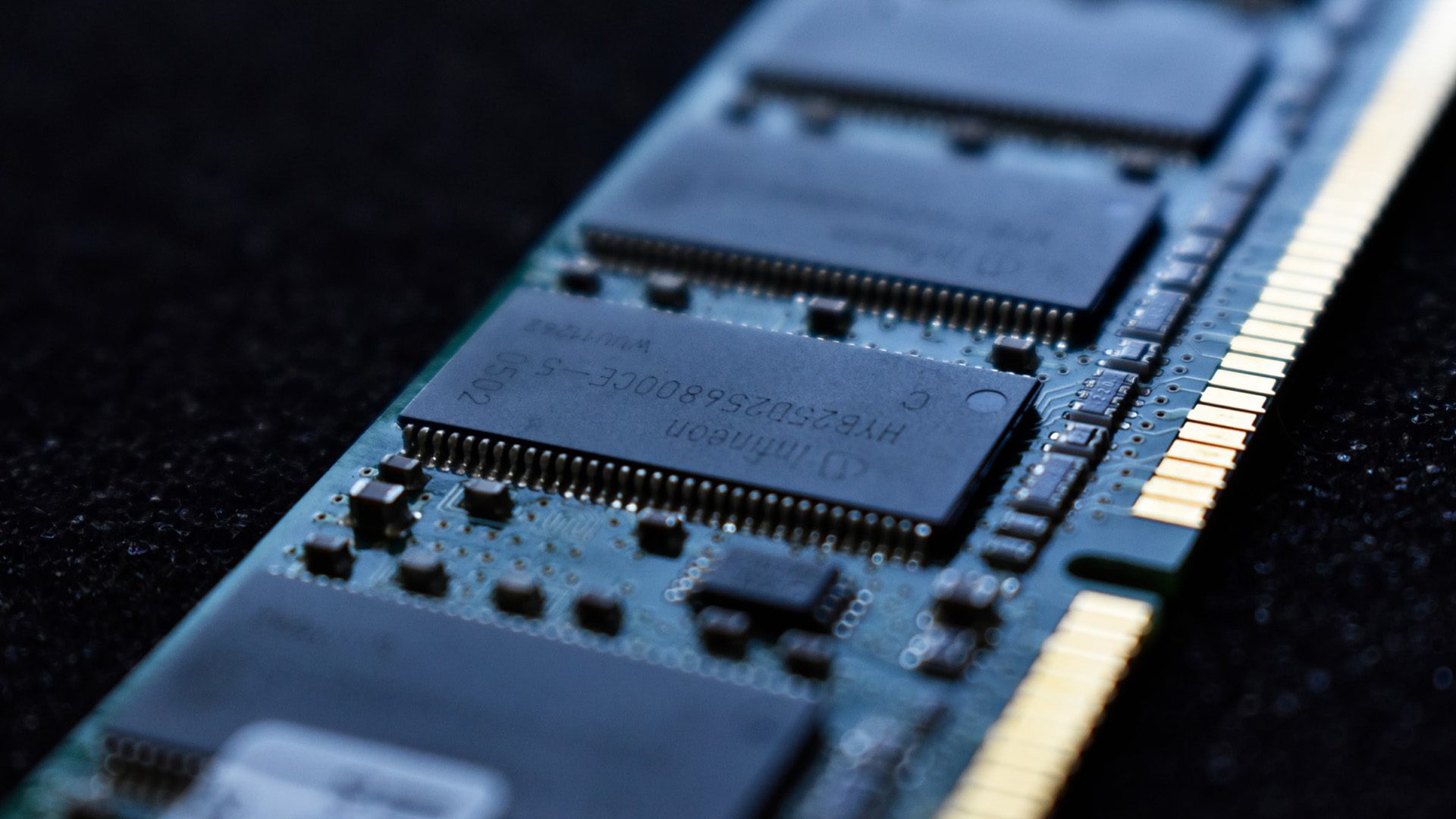

Semiconductor industry most concerned by tariffs, trade policy: KPMG

Industry leaders in semiconductor manufacturing now consider tariffs and trade policy to be their top concern, overtaking talent and labor issues, according to KPMG’s 21st annual Global Semiconductor Outlook survey of 151 executives. The report finds that a majority of companies are prioritizing geographic diversification of supply chains and increased flexibility to manage geopolitical risk. Despite these trade-related worries, optimism remains strong, with most respondents expecting revenue growth in 2026, driven by booming demand for AI and data center technologies. The survey also highlights ongoing U.S. efforts to bolster domestic manufacturing through incentives like the CHIPS and Science Act, even as proposed tariff actions create uncertainty for global supply chains.

Supply Chain Uncertainty Likely 'Here to Stay' in 2026

The article explains that supply chain uncertainty is expected to continue through 2026, driven by ongoing tariffs, geopolitical tensions, and policy unpredictability, with experts warning that global manufacturers and logistics operators will need to manage volatility as the new normal rather than expect stability. Factors contributing to continued disruption include potential U.S. Supreme Court decisions on tariff legality, conflicts in regions like Ukraine and the Middle East, tensions between China and Taiwan, and looming USMCA trade negotiations that could reshape North American supply chains. As a result, industry leaders are shifting focus toward anticipation and planning—using advanced analytics, AI tools, and strategic talent—to navigate risks like sudden rerouting, higher costs, and regulatory changes, while ports may see only modest declines in cargo volumes despite high inventory levels.

AI’s Booming Demand Meets a Semiconductor Reality Check

The article discusses how surging AI demand has driven strong growth in semiconductor sales, with global chip revenue hitting $364 billion in the first half of 2025 and the market forecast to grow over 25 % to around $975 billion, but it also issues a reality check on industry constraints: despite this boom, the broader semiconductor supply chain faces challenges such as tight memory chip supply, cyclical market risks, and capacity limitations that could slow future growth and complicate delivery of cutting-edge components needed for next-generation AI systems.

Get more articles like this in your inbox

Sign up for our monthly newsletter

Find more articles