Trump Sets Pharma Tariffs Deadline. The Fallout for Lilly, Pfizer, Other Drugmakers.

President Donald Trump has announced plans to implement new tariffs on imported pharmaceuticals within two weeks, aiming to encourage domestic drug manufacturing. These tariffs could be as high as 200%, though specific details remain unclear.

In response, major pharmaceutical companies are taking steps to mitigate potential impacts:

-

Eli Lilly has committed to investing $27 billion in building four new U.S. manufacturing plants over the next five years, creating over 3,000 skilled jobs and 10,000 construction jobs.

-

Pfizer is prepared to shift more pharmaceutical production to its 13 U.S. manufacturing sites if tariffs are imposed.

Industry analysts warn that these tariffs could lead to higher drug prices and potential shortages, especially for generic medications, due to the industry's reliance on global supply chains and the thin profit margins of generic drug manufacturers.

An executive order signed by President Trump seeks to streamline FDA approvals for U.S.-based manufacturing facilities by removing certain regulatory requirements, aiming to accelerate domestic production.

While the pharmaceutical sector's stock prices have shown little immediate reaction, the long-term effects of these tariffs on drug pricing, supply chains, and innovation remain to be seen.

China’s Stricter-Than-Ever EV Battery Rules Could Boost Solid-State, Sodium Battery R&D

China is set to implement its most stringent electric vehicle (EV) battery safety regulations to date, effective July 1, 2026. These new rules, which explicitly prohibit fires and explosions during thermal diffusion testing, are expected to significantly influence the direction of battery research and development, particularly favoring solid-state and sodium-ion technologies.

The updated regulations mark a departure from previous standards by mandating that batteries must not catch fire or explode under specific test conditions, such as bottom impact and external short-circuit tests after 300 fast-charging cycles. This shift aims to enhance passenger safety and reflects a broader commitment to improving battery reliability.

Solid-state and sodium-ion batteries are inherently safer than traditional lithium-ion batteries, as they are less prone to thermal runaway—a major cause of battery fires. Solid-state batteries, which use solid electrolytes instead of flammable liquid ones, offer higher energy density and improved safety. Sodium-ion batteries, utilizing abundant and cost-effective materials, present a promising alternative, especially for applications where cost and safety are paramount.

In response to these regulatory changes, several Chinese automakers, including BYD, SAIC Motor, and Changan Automobile, have announced plans to develop and commercialize solid-state batteries by 2027. However, experts like Ouyang Minggao, vice chairman of the think tank China EV 100, caution that while vehicles equipped with solid-state batteries may enter the market by 2027, widespread adoption could take five to ten years due to current production costs and technological challenges.

The new safety standards are poised to accelerate investment and innovation in next-generation battery technologies, positioning China to maintain its leadership in the global EV market.

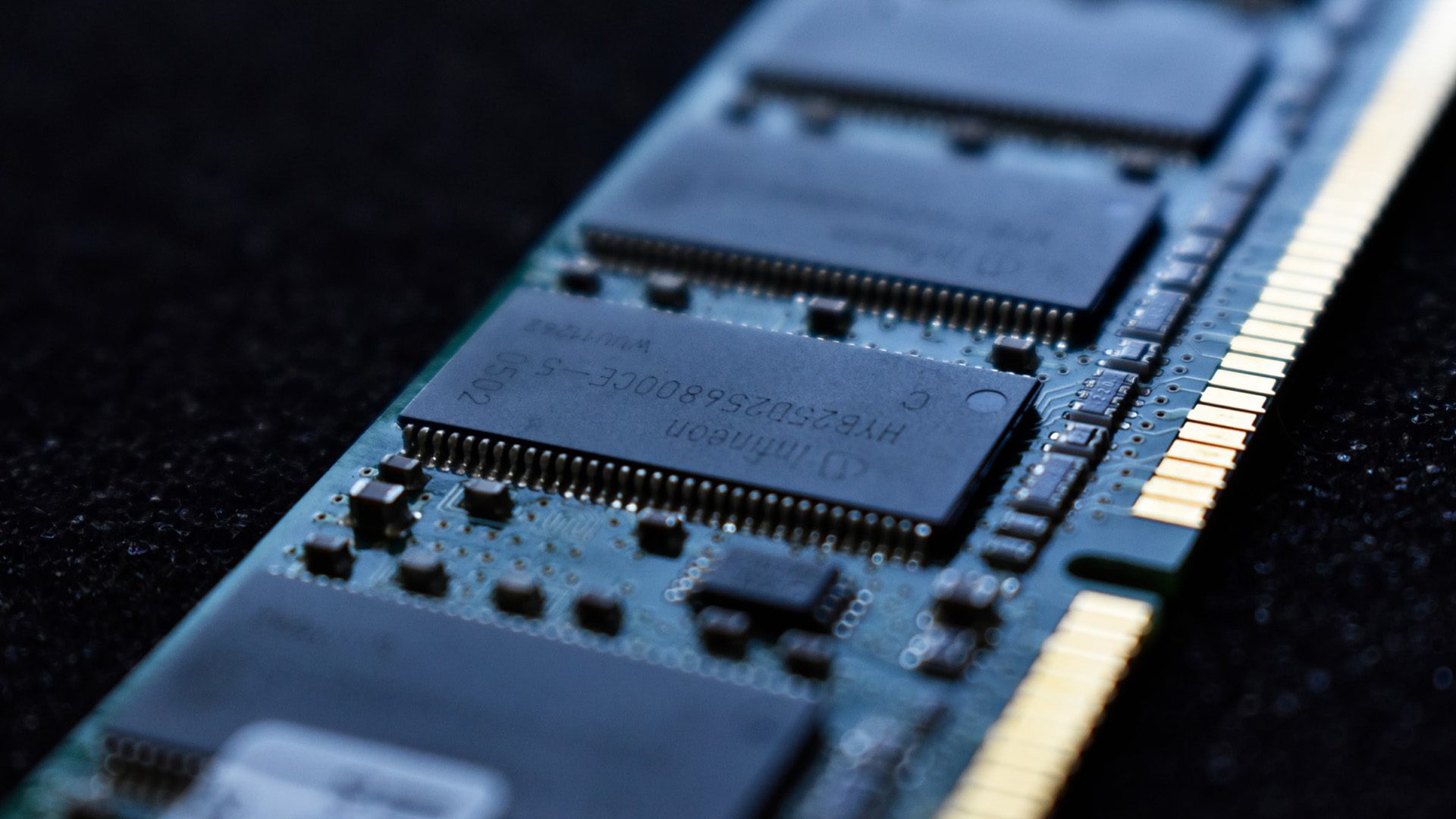

Incoming Semiconductor Tariffs Loom Over Electronics

The CEPro article discusses the impending U.S. semiconductor tariffs and their potential impact on the electronics industry.

Key Points:

-

Tariff Implementation: The U.S. government, under President Trump, is considering imposing tariffs on semiconductor imports, citing national security concerns due to reliance on foreign chip production. The public comment period for this proposal ends on May 7, 2025.

-

Affected Products: The proposed tariffs would remove existing exemptions, affecting a wide range of electronics, including smart TVs, control systems, AV processors, and lighting equipment, all of which utilize semiconductors.

-

Industry Concerns: Critics argue that such tariffs could disrupt supply chains, similar to the challenges faced during the COVID-19 pandemic, leading to increased costs and potential demand reduction for semiconductors.

-

CHIPS Act and Domestic Production: The CHIPS Act, aimed at boosting domestic semiconductor manufacturing, has provided significant funding to companies like TSMC. However, its future is uncertain due to President Trump's calls to end the bill. Industry associations advocate for the CHIPS Act as a more effective solution than tariffs for enhancing domestic production and ensuring supply chain resilience.

In summary, the proposed semiconductor tariffs could have far-reaching effects on the electronics industry, potentially leading to higher costs and supply chain disruptions. The debate continues over the best approach to strengthen domestic semiconductor production and reduce reliance on foreign sources.

Get more articles like this in your inbox

Sign up for our monthly newsletter

Find more articles